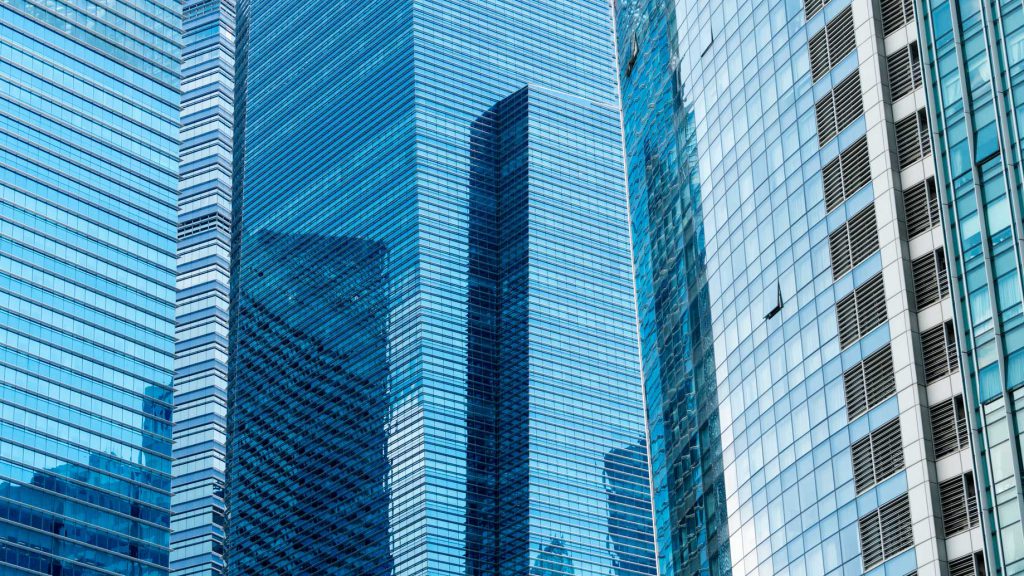

Proceedings before the courts

Representing the company’s legal interests

before the Courts

Analysis

We analyze the affected transactions and the company’s records to ensure that we have the necessary information and documentation to defend the company’s position before the Courts.

Representation

We represent the company’s legal interests before the Administrative Authorities and the Courts.

Diagnosis

We use the records and information provided by the company to evaluate the scope of the problems resulting from the agreement subject to claim, and determine possible courses of action.

Consultancy

We issue second opinions to help analyze the situation and identify possible defense strategies before determining the final course of action.

Appeals

Filing of appeals in administrative court proceedings.

International

Thanks to the support of our network of collaborators we are able to assist the company in any proceedings before the Courts in other countries.

Service details

Why?

- Often when presenting declarations, companies are required to submit certain information or undergo verification and inspection procedures that may require assistance from specialist professionals with the necessary level of experience. For companies that undertake multinational operations, the involvement of different jurisdictions can make this task even more challenging.

- Although it is possible to reduce the risk of further reassessment or of sanctions being imposed by the tax authorities by carefully monitoring incidents, nonetheless, if any such problems do arise, receiving correct advice from a local professional who is able to defend the companies interests before the Administrative Authorities in first instance and subsequently before the Courts is fundamental.

- Through our membership of an international network of firms and the use of our PlatformVAT application we are able to offer our clients comprehensive specialized support and defend their interests in Court proceedings against the actions of VAT tax authorities, not only in Spain but also abroad, in any cases in which their interests could be infringed, such as those indicated below:

- Challenges to decisions to refuse VAT refunds,

- Appeals against further reassessment or the imposition of sanctions,

- Appeals against rejected access to special schemes or tax benefits, etc.

FAQs

What advantages does our Court advisory service offer to companies?

Our wealth of experience as specialists in the field of indirect taxation, both national and international, and our extensive practical knowledge of tax operations, which we have obtained through our provision of outsourced compliance services for formal tax obligations, means that we can provide companies with valuable support in Court, in procedures related to any incidents that may arise related to compliance with tax obligations.

My company already has a tax department. Why would it need an external advisory service?

When you are personally involved in a matter, it is often hard to analyse the situation objectively in order to identify alternatives. That is why it is always advisable to get a second expert opinion from someone who can share their experiences and enrich the analysis process.

Operating in different jurisdictions can often prove quite difficult, making it necessary to turn to local experts with the necessary level of experience for advice. Where necessary we can provide these services through our international network.

Is it a costly service?

The cost will depend on the extent of our staff’s involvement in resolving the incident. In any case it is worth considering that there could be negative financial consequences for the company if it does not follow a suitable course of action, which therefore fully justifies the expenses involved.